Biggest Retirement Savings Mistakes

BIGGEST RETIREMENT SAVINGS MISTAKES.

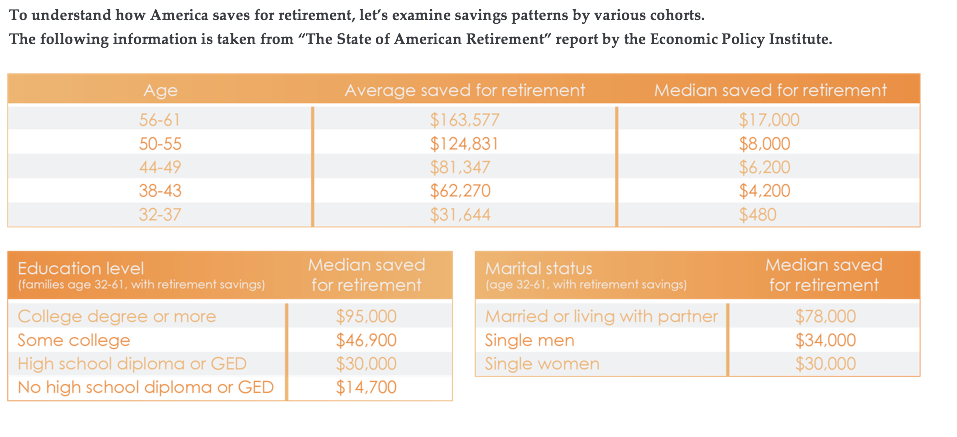

According to Northwestern Mutual’s 2018 Planning & Progress Study, a shocking 21 percent of Americans have nothing at all saved for the future, and 78 percent say they are extremely or somewhat concerned about not having enough set aside for retirement.

Everyone’s path to retirement is different, but there are general rules that can help guide your savings strategy over time. Here are retirement tips for each stage of your life:

Your 20s: Not taking the advantage of time

Fresh into your new job out of college in your 20s is an exciting time and can set the foundation for a successful financial future. The biggest mistake to avoid during this time is not getting started early and missing out on the most powerful retirement savings factor out there: time.

Recency bias can push young savers to dedicate more than is required to student loans lessening the ability to compound savings. It may be natural to think of retirement as a lower priority since it is decades away compared to student loans, both can be done at the same time.

Be sure to understand how your employer’s match works and maximize this if possible. Even if you have doubts about your current job in the long-term, most retirement savings can be transferred to your next employer or an individual retirement account should you choose to switch jobs.

Your 30s: Getting housed in

Life changing events such as marriage and children will likely start coming into play during this time. As these events occur, some savers may find themselves buying a house too early.

While you should not feel pressure to stay cramped-up in a small apartment, be sure look at your first home purchase from all angles. Buying a home too small for your growing family might not work for your needs years down the road. Spending lavishly on a big home might seem sensible now, but consider what happens in the event of a move or job transition.

Your 40s: Shifting your focus

Your early years are considered the accumulation phase but do not think that your 40s are a time to neglect retirement contributions. By this time, there are may be many different areas that need financial attention in your life. How much should you be setting aside for your child’s education? Should you use that new bonus for a home remodel?

Questions during this time can get complex and it is important to prioritize what saving areas need the most attention. Now is a good time to consult with your GuideStream financial advisor to break down these various areas and your goals for each.

Your 50s: Inaccurate assumptions

By your 50s, you likely have a clearer picture of what your savings situation looks like and can begin preparing for when you want to retire and the expenses you expect to have.

Too often, savers underestimate what they will need throughout retirement. According to a recent study featured in Wealth Professional, 15 percent of retirees globally do not have enough income to live comfortably and another 43 percent say they could have used a little more income after retiring.

Similar to your 40s, these decisions of when to retire and how much will be needed can be complex to navigate. With the help of your GuideStream financial advisor, consider all of the factors that may be in play. These can include upcoming healthcare costs, what happens in the case of an underperforming market, and other scenarios.